Western Christendom experienced a sea change in the late 17th century. On one side of that divide was theological dogmatics, scholastic philosophy, the divine right of kings and priests, and, seemingly in their train, wars of religion; on the other side, there was theological indifference, mechanical philosophy, government by consent of the governed, latitudinarian and sectarian church polity, and the political balance of power. Not that these things came all at once; but the tendencies were clear. The mood and temper of the peoples had swung; religion lost its position of overriding importance, to be replaced by economic and political considerations, reason of state, and the wealth of nations.

A pantheon of figures has been elevated to apostolic status as trailblazers in the transition from the Darkness of the one side of this great divide to the Enlightenment of the other. Hugo Grotius, Rene Descartes, Baruch Spinoza, John Locke, Pierre Bayle, Montesquieu, Voltaire, all figure in enumerations of enlightened progenitors of the new era. Paired with these names was a new theoretical orientation which determined the mindset, the Zeitgeist, the Weltanschauung of this new dawn: a new science putting the categories “nature” and “natural law” on a new footing, providing the essential authoritative basis for the new order.

Thus “nature” was the determining factor. The “imperative of nature” came to dominate all areas of inquiry and practical philosophy. The “state of nature” became the orientating condition; rights in a state of nature came to be the touchstone of all just legal and political order; natural religion, religion in accordance with the dictates of nature, came to be touchstone to judge revelation, or at least to form a stand-alone, autonomous body of knowledge alongside revelation; and a new school of thought, economics, arose from out of the disarray of “mercantilist” controversy, basing itself upon – you guessed it – nature, with the initial iteration provided by Richard Cantillon and François Quesnay, and which issued forth as “physiocracy”: the rule of nature.

Perhaps one figure above all others represented and personified this trend. That would be Isaac Newton, the progenitor of the paradigm that anchored all these areas of thought in terms of a unified theoretical construct. Newton put science on a new plane, providing an integrated theoretical explanation for phenomena that had stumped scientists for generations; and it was upon this foundation that the orders of religion, law, politics, and economics were shunted. Alexander Pope’s well-known “Epitaph on Sir Isaac Newton” was, if anything, an understatement of the sentiment of the age:

Nature and Nature’s Laws lay hid in Night:

God said, “Let Newton be!” and all was light.

Christian theology became wedded to Newtonian physics, which in particular served as a tool of apologetics.[1] The philosophy of law and politics, already argued in terms of the individual and consent, received a powerful support from the notion of an atomistic universe. And this very same Newtonian construct likewise served to buttress the budding school of classical economics with all of its “natural laws” of wealth and poverty centering on the individual and self-interest.

In all of these areas, Newton’s philosophy, the “settled science” of the day, supplied a powerful sanction. But this is not everything there is to know about Newton. Some areas of his labor, to which he devoted at least as much time as his scientific investigations, have come to light of late, after having languished in the obscurity they were left in by hagiographic biographers determined to highlight the rational character of one of the chief developers of the scientific method, while ignoring what they deemed to be irrational. And Newton exhibited this “irrationalism” in spades.

One of these areas was biblical study. Newton devoted a great deal of time and effort to biblical chronology and to deciphering the Temple of Solomon. The latter in particular he held to be an expression of hidden truth to be unraveled by the initiate. This interest in the Bible and in theology, along with Newton’s clear belief in the biblical version of events regarding, e.g., six-day creation and the Flood, were enough to put a serious dent in Newton’s reputation as the objective enlightened scientist. But the most egregious offense in this regard was provided by the realization that Newton dabbled in alchemy. More than that: he spent a major portion of his investigative life, not in scientific experimentation, but in alchemic explorations, pursuing the transmutation of elements.

It was John Maynard Keynes who first lifted the lid on this aspect of Newton’s legacy. “Newton was not the first of the age of reason,” Keynes wrote in his posthumously published and delivered lecture, “Newton the Man.” Rather, “He was the last of the magicians, the last of the Babylonians and Sumerians, the last great mind which looked out on the visible and intellectual world with the same eyes as those who began to build our intellectual inheritance rather less than 10,000 years ago.”

Keynes discovered the “real” Newton while perusing a box of forgotten documents he obtained at an auction in 1936. This led to a radical reevaluation on his part. “In the eighteenth century and since, Newton came to be thought of as the first and greatest of the modern age of scientists, a rationalist, one who taught us to think on the lines of cold and untinctured reason. I do not see him in this light. I do not think that any one who has pored over the contents of that box which he packed up when he finally left Cambridge in 1696 and which, though partly dispersed, have come down to us, can see him like that.”

That box revealed Newton the alchemist. Alchemy is the pursuit of transmutation, and Newton avidly pursued it. What the alchemists were after was gold. What one needed for that was the philosopher’s stone; with that in one’s possession, one might convert base metal into the precious yellow metal.

It goes without saying that Newton never came into the possession of such a stone, nor did he ever successfully transform base metal into gold. But it cannot be said that he was altogether unsuccessful in his manipulations in favor of the yellow metal. And here comes the part of the story that is never told, because insufficiently understood. It is the story of how Newton participated in one of the great transformations of world history: the shift of England’s currency from silver to gold, which precipitated the change from a coinage- to a banking-based monetary system. He did so as Master of the Mint, a position he occupied from 1699 until his death in 1727.

A little background is in order at this point. The 16th century witnessed the development of a new order of trade, or, in Immanuel Wallerstein’s terminology,[2] a world-system integrating far-flung areas of the world into a trading network. At the center of this trade network was the fledgling Dutch Republic. In the face of the mercantilist imperative – policies to maximize the retention of precious metals in order to maintain a viable domestic circulation – the Dutch Republic instituted a novel arrangement with regard to currency, dictated by this trading network.

This arrangement facilitated trade with the East. This was because the West ran a chronic trade deficit with the East. There was nothing new about this; from the early medieval period on, the West basically had nothing to offer the more advanced East than such things as furs and slaves, the latter until the slave supply from the Western countries dried up. But there was great demand in the West for what the East had to offer: for instance, silks and spices. How to finance the importation of these luxury goods? Silver.

The one thing the West had that the East wanted, especially since Spain’s discoveries in the New World, was silver. Silver in the East carried a premium vis-à-vis the West, making it profitable to export: this was what made it effective as a means to settle up the trade deficit.

Thanks to new mining techniques and Christopher Columbus, silver became abundant in the 16th century, precipitating the so-called Price Revolution of that century. But in the 17th century the supply began drying up, one of the factors behind the so-called General Crisis of the 17th century and one of the spurs to the spate of policy proposals and implementations summed up in the term “mercantilism.” For one thing, the mines of New Spain were not producing as much as they once did. For another, the flow of silver to the East, primarily China – that bottomless pit, “the World’s Silver Sink”[3] – was beginning to have its effect.

The Dutch Republic served as the funneling mechanism for this flow. Its counter-mercantilist policy allowing the free import and export of specie, and the demand for silver for export exerted a magnetic attraction from all over Europe, with the resulting abundance of coin even precipitating the Tulip Mania of the 1630s.[4] Much of it simply went to offset the burgeoning import business.

English merchants watched all of this with proverbial Argus eyes. They looked on as the Dutch East India Company established its trading network, helped by its special advantage of readily available specie. They sought ways to get around the royal prohibition on the export of currency, and chafed under the restriction.

The breakthrough came in 1663, with the passage of legislation establishing a regime of free coinage. Del Mar finds the impetus for this legislation in the intrigues of Barbara Palmer, Duchess of Cleveland, Charles II’s mistress.[5] With this opening, the East India Company worked diligently to build its own trading network. The needed silver it obtained, among other places, from the domestic circulation, precipitating a dearth of coin. Together with the wars against Louis XIV conducted by “King Billy,” the Dutch stadhouder become King of England, this precipitated an economic and budgetary crisis.

This decimated the coinage, which suffered from debasement at minting as well as the techniques of clipping and sweating. As a remedy, the wise men of the age recommended a restoration of the coinage to the condition it enjoyed under Queen Elizabeth a century earlier. According to Whig historiography, the great men who recommended this measure, occupants of the Enlightened Pantheon, men like John Locke, here once again displayed their sagacity. Post-Whig reassessment has been less kind.[6]

The attempt to restore the coinage to the silver content of days when silver was abundant had, as its detractors predicted it would, a strongly deflationary effect. And it had the opposite result than hoped, for it simply provided a prime source of silver for export. Full-weight silver coins were simply too juicy to let pass. On these terms, it was quite simply more profitable to export silver than allow it to continue in circulation.

So the result of the so-called Great Recoinage was virtually to establish gold as the currency standard for England.[7] Here is where Newton comes in. As Master of the Mint, Newton ensured the continuation of this trend, maintaining a ratio of silver to gold (15 ½ to 1) that upheld the continued priority of gold over silver. By pricing gold favorably against silver, this ratio ensured that the export of silver in favor of gold would continue to be profitable. Both Newton and Locke indicated the direction that the natural philosophy was going to take with regard to economics: the commodification of money, with all the consequences that this would entail.

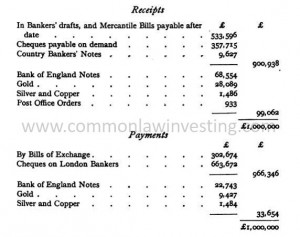

But the establishment of gold at the heart of the English currency system had another consequence of a different order: it established fractional-reserve banking in place of coinage as the “money method.” This system of banking had a magical working. It turned paper into gold, or gold into paper, for it multiplied a bank’s specie holdings and circulated a currency “as good as gold” albeit many times the actual amount of gold. This alchemical process actually worked, contrary to Newton’s experiments with the philosopher’s stone. And so Newton stood at the cradle of a new alchemy with far-reaching consequences.

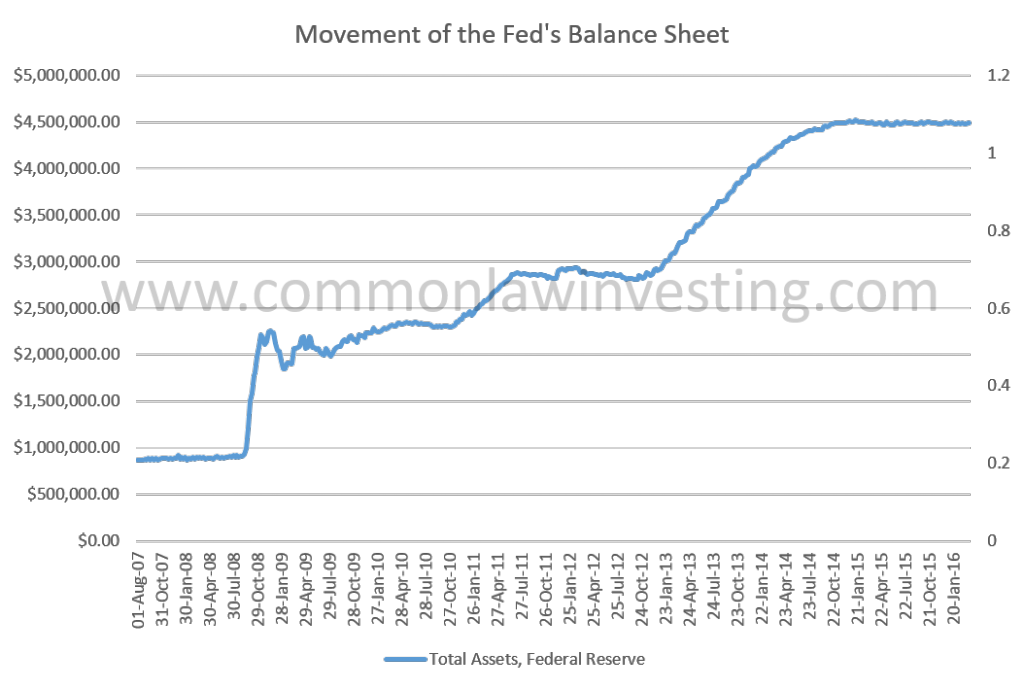

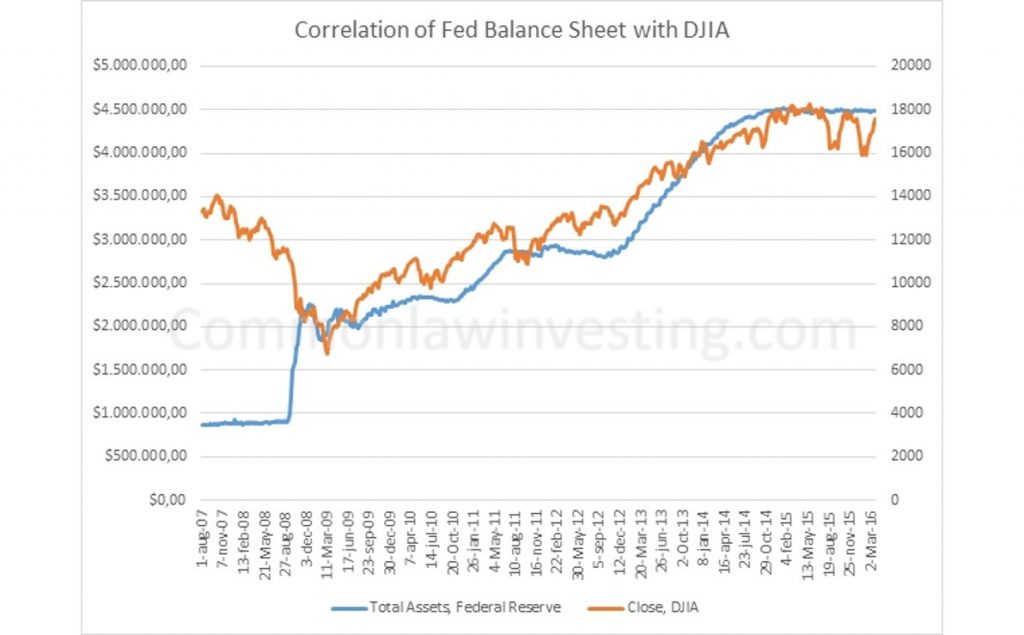

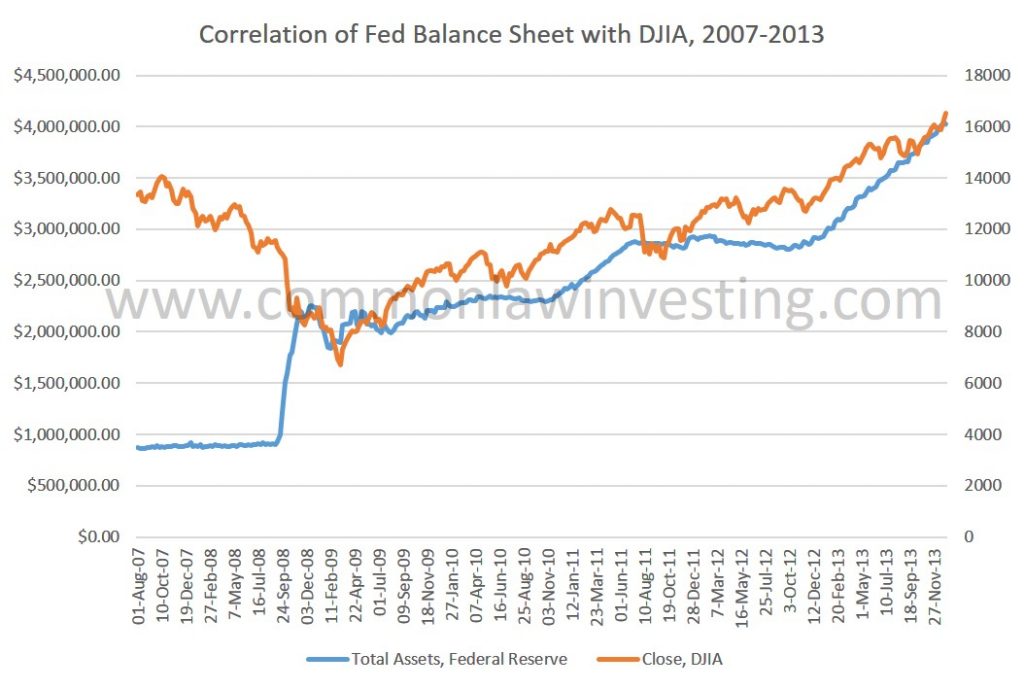

It is one of those curious coincidences of history that Keynes, considered by many to be the modern progenitor of the alchemy of finance, was the first to discover and publicize Newton’s own alchemical wizardries. Keynes’ alchemy consisted in the magical transformation of fiat currency into productivity, growth, and wealth, simply by wielding “effective demand.” Newton’s consisted in the more mundane magic of the multiplication of gold reserves. “Their works follow after them,” for their alchemy lives on. In our day and age, the paradigm of alchemical transmutation has crossed over even into biology and gender. As such, it is the pulsating heartbeat of the age in which we live, all pretensions of scientific rationality notwithstanding.

[1] See in particular Margaret C. Jacob, The Newtonians and the English Revolution 1689-1720 (Ithaca, NY: Cornell University Press, 1976).

[2] Immanuel Wallerstein, The Modern World-System I: Capitalist Agriculture and the Origins of the European World-Economy in the Sixteenth Century, with a New Prologue, vol. 1 (Berkeley, CA: University of California Press, 2011 [1974]).

[3] Dennis O. Flynn and Arturo Giráldez, “Born with a ‘Silver Spoon’: The Origin of World Trade in 1571,” Journal of World History, Vol. 6, No. 2 (Fall, 1995), p. 206.

[4] Doug French, “The Dutch Monetary Environment During Tulipmania,” in The Quarterly Journal of Austrian Economics (Vol. 9, No. 1, Spring 2006), pp. 3-14.

[5] Alexander Del Mar, Barbara Villiers: or, a History of Monetary Crimes (New York: Cambridge Encyclopedia Co, 1899).

[6] For instance: Peter Laslett, “John Locke, the Great Recoinage, and the Origins of the Board of Trade: 1695-1698,” in The William and Mary Quarterly, Vol. 14, No. 3 (July 1957), pp. 370-402.

[7] A recent article making this case is Charles James Larkin, “The Great Recoinage of 1696: Charles Davenant’s Developments in Monetary Theory” (2006), available at https://goo.gl/JtcWCH.