A reprieve, not a resolution

In the face of the low-growth environment, central banks like the Fed have cut interest rates to hitherto-unseen levels, creating a so-called zero-interest-rate environment. They do so in an attempt, following the monetarist formula, to “inject liquidity” into the economy. But, as we have seen, central banks operate on the financial market, not the ordinary market; their attempts to “stimulate” the economy run within the financial market; true stimulus requires the agency of the actors on the ordinary market, i.e., banks, business, and consumers, to expand production and consumption.

This inability to stimulate the real economy has been characterized as “pushing on a string,” which obviously is an exercise in futility. At any rate, zero or near-zero interest rates have not stimulated the economy, so central banks are resorting to another strategy: “quantitative easing.” This is another form of relaxing monetary policy, only this time it is not interest rates that are manipulated, but the quantity of money. The way it works is that the central bank engages in open-market operations, just like before, only this time not with an eye to raising or lowering the interest rate, but in order to inject liquidity into the system. By buying assets on the financial market, it puts money into the hands of the market players, in the first place the so-called primary dealers who have direct dealings with, e.g., the Fed. This expansion of the money supply is then supposed to trickle down to the ordinary market, the real economy. But all it really has done is exacerbate asset bubbles on the financial market.

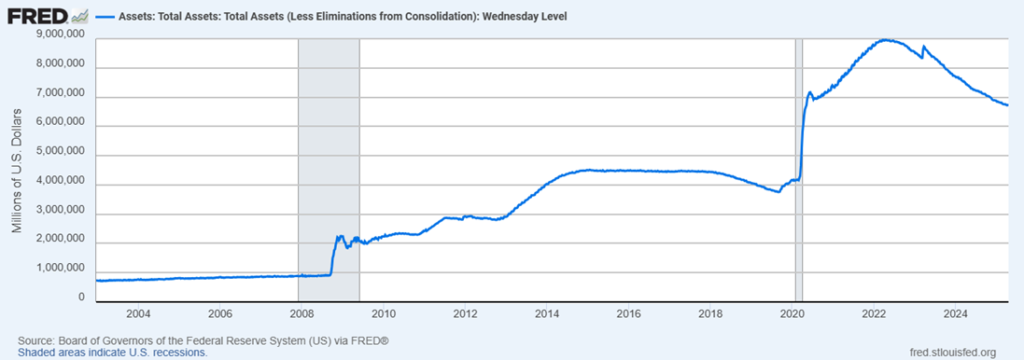

As an example, let us look at the quantitative easing program carried out by the Federal Reserve. In the wake of the crisis of 2008, the Fed greatly expanded its asset purchases, and the assets listed on its balance sheet increased accordingly. Beginning in late 2008 – the onset of “QE1” – the balance sheet more than doubled. Interestingly, the Fed for the first time began buying mortgage-backed securities – the same kind of derivative product that had so fallen out of favor in the credit crisis – suggesting a dual purpose to this strategy: banks could offload bad debt to the Fed and receive money for it – another form of “stimulus.” At any rate, when stimulus proved ineffective in stimulating the real economy, there followed QE2 and QE3, bringing the Fed’s balance sheet to around $4.5 trillion, an astounding figure in the light of history.

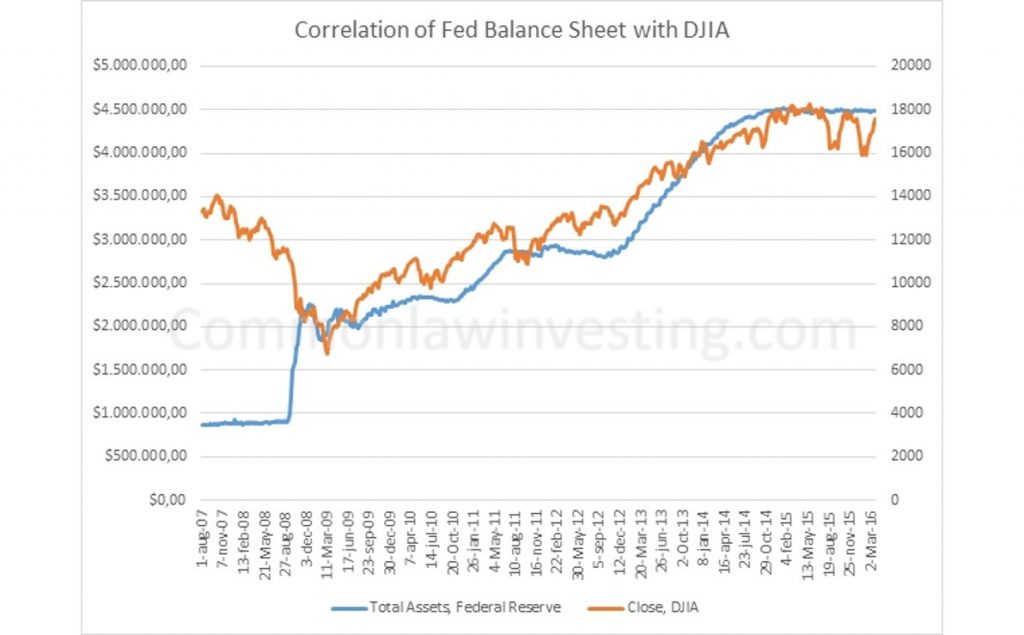

Interestingly enough, this Fed action did seem to stimulate the stock exchange, entirely in line with the thesis of the two markets as represented in our discussion. As the graph below indicates, the Dow Jones Industrial Average (DJIA) has moved entirely parallel with the Fed’s balance sheet expansion. Whether this is sheer coincidence or not, we leave the reader to decide for himself.

This graph was composed of data issued by the Federal Reserve and by S&P Dow Jones Indices LLC.

Update 2025: Since 2020 the situation has become much more acute. In two years’ time, the Fed’s balance sheet doubled in size to a total of nearly $9 trillion before being reduced to just under $7 trillion. Remember, all of this is debt which the Fed has purchased, in this way “pumping” liquidity into the financial market.