While the USA experienced a severe bout of inflation throughout the 1970s and into the 1980s, Japan dealt decisively with the same problem and got inflation under control. It then began pursuing a policy strategically to peg the yen to the dollar at an exchange rate favorable to its export industry. It sacrificed its domestic economy and the affluence of its producing, especially working, classes, to the exigencies of maintaining high levels of exports and a high trade surplus.

How was this done? By pegging the yen at an artificially low level vis-à-vis the dollar – artificially low, because given the trade surpluses the country began running, a truly floating currency would have adjusted by appreciating. But the yen did not appreciate, and the trade surpluses – mirrored by US trade deficits – remained stubbornly high.

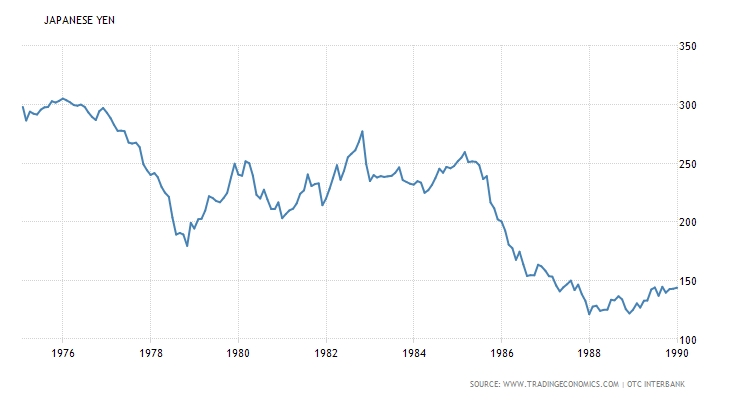

A few graphs will make this clear. Figure 10 charts the exchange rate between the dollar and the Japanese yen from 1975 to 1990.

Beginning around 1979, the dollar maintained an appreciating trend against the yen until towards the end of 1985. From that point, the dollar began depreciating dramatically, until the end of 1988, when it began appreciating again.

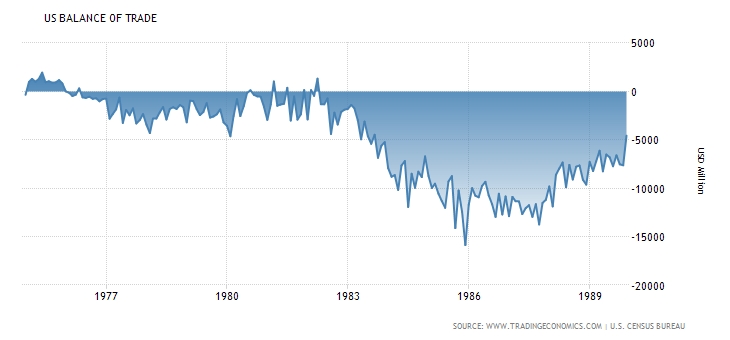

Now let’s take a look at the balance of trade. Figure 11 shows us the US balance of trade between 1975 and 1990, showing that towards the end of 1982 the USA began running a significant trade deficit.

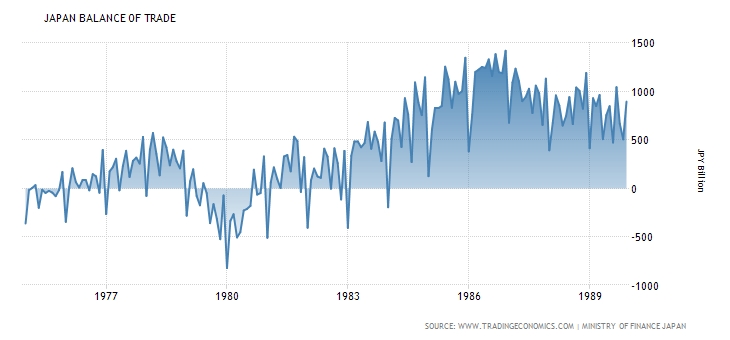

Now let’s take a look at Japan’s balance of trade.

Japan began running a significant trade surplus at around the same that the US began posting a significant trade deficit, viz., 1983. The gap began narrowing again in 1987.

What was behind this? First, Japan’s trade surplus was generated primarily by selling to the US: most of the US trade deficit stemmed from trade with Japan. So these moved in lock-step, as suggested by comparing figures 10 and 11. And this trade deficit was stimulated by the continued strength of the dollar: comparing figure 9 with figs. 10 and 11 is suggestive enough. Why didn’t the trade deficit lead to any readjustment in the exchange rate until 1985? One reason for this is that the US ran significant budget deficits, which fueled enough consumption to override that effect: Japan, with its high-quality goods, filled much of that demand, even as their prices rose. A forced intervention to weaken the dollar was carried out to redress this. This was arranged in the Plaza Accord of 1985, which provided for coordinated central bank action to force downward the dollar exchange rate with other major trading partners, above all Japan. What happened was, the dollar plunged vis-à-vis the yen; this was only arrested in 1988.

Questions: