The Japanese “asset bubble” of the late 1980s forms another element of the whole picture.

In order to compensate for lost export sales, the government and the Bank of Japan sponsored the inflation of asset prices – in particular, real estate and stock prices – by dictating that the banking system generate liquidity by lending against collateral at inflated prices. This process has something of a self-generating spiral to it: the more money is lent against inflated asset prices, the more those asset prices rise, against which to lend more money. The money went to companies to generate “production,” most of which was unnecessary and without prospect of a return.

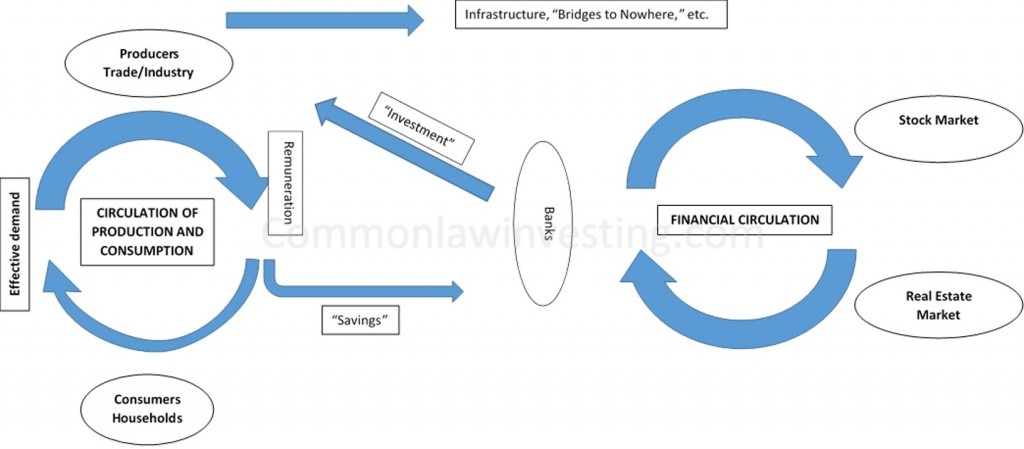

A highly simplified rendering of this process is given in Figure 17.

The bubble burst around 1990. It left behind massive indebtedness that could not be allowed to default, because it would lead to the destruction of too much of the Japanese business and financial world. So it was kept on the books and rolled over. Over the years, this debt load has only increased, as the Japanese government has attempted stimulus after stimulus. The debt overhang still exists, dragging down Japanese economic performance with it.