The student outperforms the teacher

If Japan pioneered the Asian Tiger model, its apprentice, China pushed the model to new heights, in so doing helping to foster the credit crisis of 2008 and the ongoing global debt overhang, which threatens to asphyxiate future prosperity.

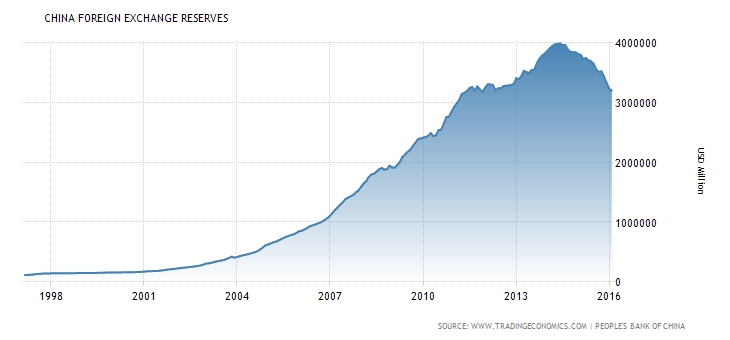

Even though China never was a participant in the Bretton Woods agreement, it historically has pegged the yuan to the dollar. This took on great importance after 1997, when China moved into the role of the world’s leading manufacturer. To maintain this peg in the face of ever-increasing exports and trade surplus, China, similar to Japan, resorted to a program of sterilization (forced dollar savings). For completeness’ sake, the situation is represented in Figure 18; it is entirely analogous to the yen situation sketched above.

In this manner, China could build and maintain its position as the world’s leading manufacturer. Its productive capacity continued to grow, while the productive capacity of the importing countries (e.g., the USA) continued to be hollowed out as manufacturing capacity was exported.

The situation is reflected very clearly in the two figures below. Figure 19 shows China’s balance of trade, while Figure 20 shows its foreign exchange holdings. The correlation between the two is evident.

Figure 19: Balance of Trade, China, 1997-2016

The extent of China’s foreign exchange holdings is enormous, dwarfing even Japan’s; they “far exceed even the most generous estimate of what would be appropriate” (Michael Pettis, The Great Rebalancing, ch. 1).

The effect of this trend has been manifold. Firstly, the conditions of the importing countries’ labor market has been seriously undermined, with “the best jobs” being exported abroad. Secondly, the conditions of the working class in the producing countries (e.g., China) has not been elevated nearly as much as it should have been if they were remunerated fairly. As explained above, this has been done to keep them from consuming, which would put more domestic currency in circulation and lead to currency appreciation. The gainers have been the political elites responsible for maintaining this arrangement, and the multinational corporations profiting from so-called Global Value Chains (GVCs), ostensibly the outworking of Ricardo’s doctrine of comparative advantage, but in reality a scheme to keep labor costs artificially low while maintaining a captive sales market. After all, it is not important if laborers in importing/consuming countries don’t have jobs, for their welfare states will enable them to maintain consumption levels, at least until government indebtedness, which funds this consumption, reaches unsustainable levels.